Topics for Discussion

Are you Young and Successful? An IUL might be just what you need!

Kris Sollenberger, Life Insurance Pro, Scottsdale

21 June 2017

Okay, there’s a lot of you out there…… You breezed through college in 4 years or less, got your dream job in your 20’s, and ever since then, you’re on the fast track to an amazing successful life! What now? What do you do with these ever-increasing paychecks? Put your money into a very slow-moving savings account? Buy a house? Invest with a broker?

Well, what if I told you that there is a way for you to protect against inflation, take advantage of the market where you reap the gains, but at the same time are protected against the losses, AND if that wasn’t enough, in case something happens to you, your family will be protected with a big lump sum of money.

Seem too good to be true? It’s not, it’s a little investment tool called Index Universal Life Insurance (IUL).

“Your money is not invested in those accounts, it’s just measured by their performance. So, if it goes up, you get a percentage of that put into a separate account. If the market goes down, you do not lose money, you just don’t earn any extra that period.”

IUL’s are like any whole life insurance product. It guarantees a payout upon death, and it holds cash value that goes up over time as premiums are paid. You can tie your money to an index account such as the S&P 500 or Nasdaq. Your money is not invested in those accounts, it’s just measured by their performance. So, if it goes up, you get a percentage of that put into a separate account. If the market goes down, you do not lose money, you just don’t earn any extra that period. All the while let’s not forget, your family is protected if something happens to you (a.k.a traditional life insurance). Make sense? Seems kind of cool right?

Let me set the record straight. An IUL is not for everyone. The gals and gents who would likely feel the most comfortable paying the premiums for this product are those successful people who have surplus money to invest.

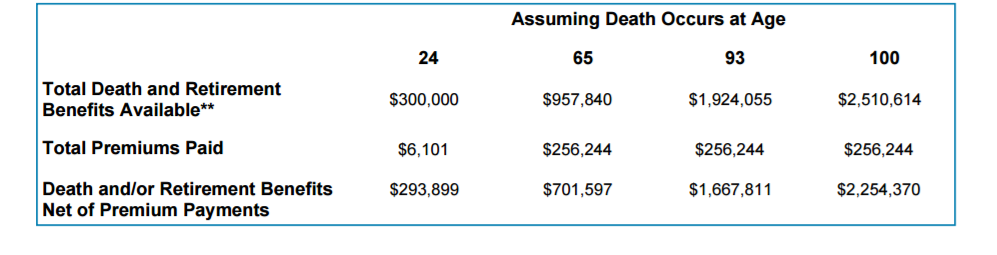

One strategy that has proven beneficial to many policy holders is to front load these accounts with high premiums at the beginning, which leads to increasing amounts of money being invested for higher gains. Let’s take a look at what could happen to a 24-year-old who puts $500 a month ($6,000/year) into his IUL until he is 65 years old (The cool thing with this IUL example is, he will stop paying premiums at 65, but his money will continue to grow). See the chart below.

These numbers are conservative numbers too. If the interest rates are higher than the 4.4% like we used here, you will earn more cash value. It’s amazing how much more you earn with just a little higher rate.

What are you waiting for? Take advantage of the fact that you are young AND healthy right now. You will pay less for a policy the healthier and younger you are. Check it out!

If you are interested give me a call or shoot me an email! I would be more than happy to share with you more of the benefits of an IUL, and create a table that could represent your gains based on your stage in life and desired monthly premiums.

Interested?

Give me a call: 480-400-0225

or shoot me an email: Kris@123EasyLife.com

I would be more than happy to talk more about how an IUL could make a great addition to your retirement savings portfolio.

Get Insured

About

123EasyLife.com

The offices of

American Retirement Advisors

Scottsdale

8501 E. Princess Drive

Suite #210

Scottsdale, AZ 85255

Las Vegas

8072 W. Sahara Ave

Suite #A

Las Vegas, NV 89117

© 2017 123EasyInsure Privacy/ADA

123EasyLife.com is an affiliate of 123EasyInsure a licensed independent insurance broker. 123EasyLife.com does not underwrite any insurance policy described on this website. The information provided on this site has been developed by 123EasyLife.com for general informational and educational purposes. We do our best efforts to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. License Numbers: AZ: 880193 CA: 0H22516 OH: 1146137